DISCLAIMER: The opinions and comments expressed in this post/video and all posts/videos of the “Analyst Roundup” Substack only reflect those of the Author and do not reflect those of any other individual or party, especially the Author’s employer(s) or affiliations.

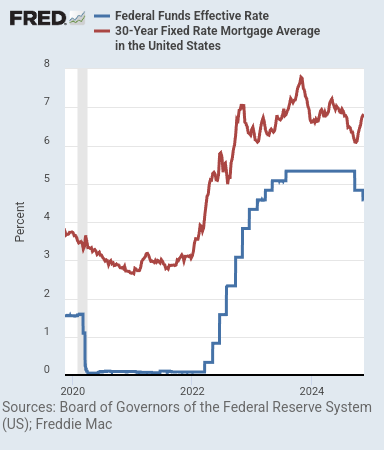

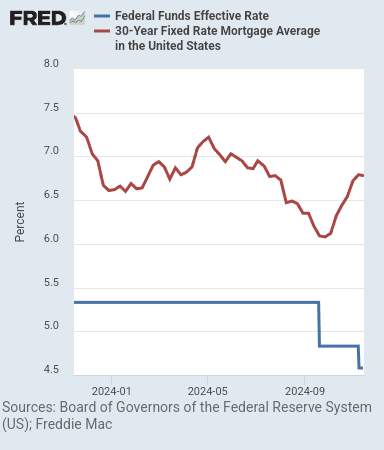

As the 5-year and 1-year history charts below show, there is divergence in trajectories between mortgage rates and The Fed's effective rate.

This is likely the result of continued, significant increases in Federal debt, with annual growth in new issuance still outpacing economic growth.

While certain facets of financing are becoming more available (auto loans, household credit, BNPL), I would not expect the interest rates to drop much for these products and mortgages in the future, even as The Fed drops its rate incrementally. This divergence may be necessary to offset the potential for a resurgnce of inflation.

Share this post