DISCLAIMER: The opinions and comments expressed in this post/video and all posts/videos of the “Analyst Roundup” Substack are intended to be objective and nonpartisan. These opinions and comments only reflect those of the Author and do not reflect those of any other individual or party, especially the Author’s employer(s) or affiliations.

Yes, we saw a slight decline in the measure of inflation-adjusted Gross Domestic Product, moving an compounded annual rate of -0.27% for the First Quarter of the year.

Nobody likes to see good numbers go down, even though some respected prognosticators in Atlanta thought it would crater (see my post from this morning). In reality, this was pretty close to the late expectations of forecasters, which at least indicates that the math is consistent.

How did this happen? Yes, it was because of imports, which shot up and obliterated growth in every other element contributing to the GDP calculation, including consumer spending. The table below (using BEA data) shows the key elements of how we get to the final number.

The math tells us the ports, airports, and trucks (from both sides of the border) were very busy, as some tried to bring goods in before the tariffs took effect.

That spike in the solid blue line is imports climbing over 8.6%, while exports grew less than 0.5%.

The imports also contributed to the considerable growth in Gross Private Investment (hence the need for a net adjustment). DOGE also chimed in, as a reduction in Federal spending translated to a downward pressure on the economy (albeit, not as significant as the disruption impacting the private economy).

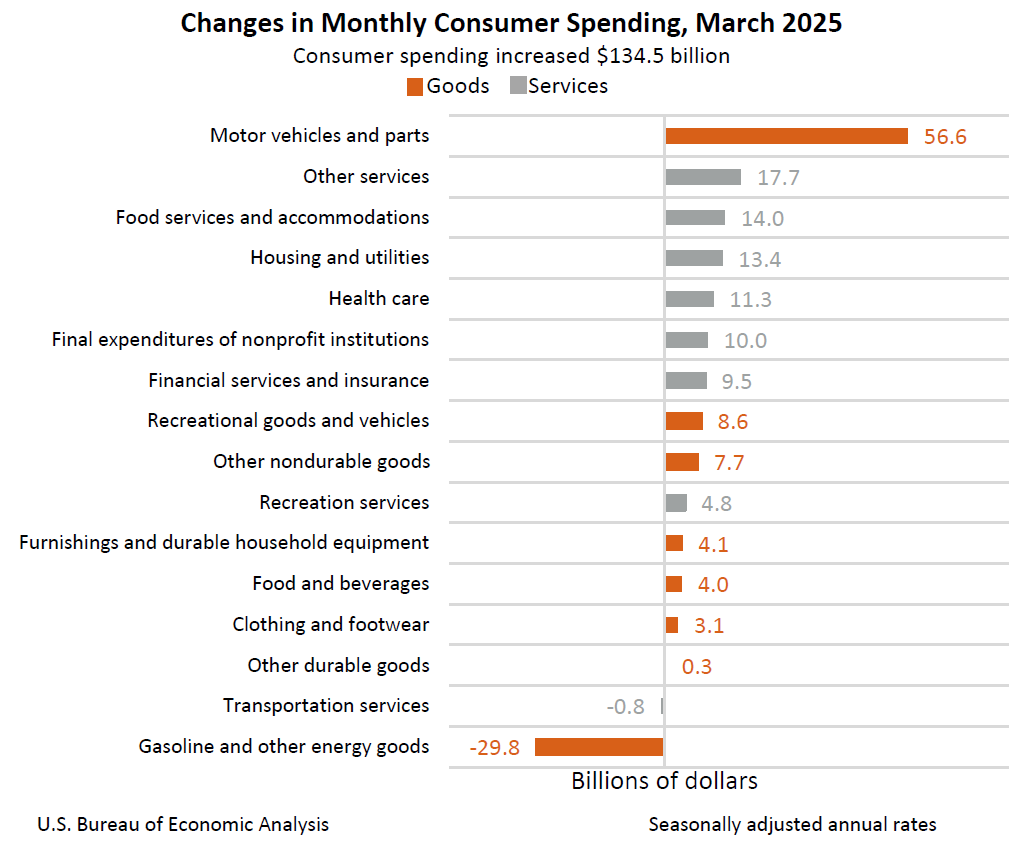

BEA also reported today on Personnel Incomes and Outlays (i.e., Spending). Their numbers parallel the consumer spending growth we saw in March with respect to the growth…

And where it went.

There will be adjustments at the end of May and June to these numbers, and I imagine the Second Quarter will tell a completely different story. I just don’t know (yet) what that story will be.

Share this post