DISCLAIMER: The opinions and comments expressed in this post/video and all posts/videos of the “Analyst Roundup” Substack are intended to be objective and nonpartisan. These opinions and comments only reflect those of the Author and do not reflect those of any other individual or party, especially the Author’s employer(s) or affiliations.

As I mentioned on July 4th, I am not a fan of Presidents signing Bills, especially significant ones, on Independence Day. Going back a couple years to the original “Triple-B” (i.e., OTB) introduced by one of today’s top professional wrestling heels, MJF, it’s an intentionally polarizing move to “push” something applicable to and controversial in the present on a day where the goal is to achieve some semblance of shared appreciation and celebration of our Nation.

Now, let’s objectively discuss an objectively Frankenstein-ish piece of legislation (as all omnibuses are) that advances much of the domestic policy agenda the President (and his supporters) telegraphed before and after his election victory last November.

States have A LOT of Work to do

The President must love layered-cake more than marble (or as a student properly advised me for today’s parlances, confetti) from a Federalism perspective, as the OTB seeks movement to more definitive and separate roles between Washington and the States, especially when it comes to paying for their biggest fiscal responsibility: Medicaid.

Costs for entitlement programs are completely tied to eligibility, and the OTB tries to achieve its intent for reduce overall Medicaid spending by $1 Trillion over the next 10 years. Work requirements and out-of-pocket payments by recipients are incorporated into the bill, which may (analytically) reduce costs. However, the most notable means of cost reduction for Washington come from shifting share to State responsibility, especially with forced cuts in the ability for States to maximize revenues through their taxation of Medicaid activities.

As I’ve believed for quite a while, “Medicaid expansion” was a fiscal Trojan Horse for States that put it in place, and that weapon has now been cut open behind the walls. Those States that have already adopted budgets for the new fiscal year are going to need to call Special Sessions to adapt their plans accordingly. For those who haven’t (including North Carolina), existing debates shift as State Legislatures work to balance within available revenues (and goals with their own taxation plans) with the reality of higher cost share levels.

The biggest concerns with reductions in Medicaid spending deal with accessibility to essential healthcare for those in need, both in general and within reasonable proximity to their home. Hospitals located in and serving rural (less-populated) areas are going to deal with financial challenges. While the OTB does include a $50 Billion provision for these entities, the next couple years will show us if these essential operations will be able to stay afloat, and whether or not States will pick up the slack.

While they’re discussing health care for those in need, States will also have to figure out how to assume some of the responsibility for benefits provided their residents under the Supplemental Nutrition Assistance Program (starting in 2028).

No Household Tax Increases

When you look at the OTB, it is clear that any impact on household spending will not come in the form of increased Federal Taxes. I can say that objectively, and I can also say some households may see increased cost of living as a result of The OTB’s reduction of transfer payments (directly and indirectly, see Medicaid).

Along with extending Trump’s personal income tax brackets, The OTB adds a tax deduction for domestic car loans (sheesh, really?) and creates tax exemptions for tips and overtime.

The biggest winners in this category are households over 65 (i.e., your parents and grandparents), as they can receive a deduction of as much as $6,000 per year, on top of increased standard deductions. Parents aren’t far behind, as Child Tax Credits see a bump (and more importantly, permanent status), and if they so choose, access to tax benefits for choosing private schooling.

Thankfully, state and local governments DO benefit, as early targets of potential net savings (i.e., state and local tax deductions and deductions in state and municipal bond interest) were not curtailed. In fact, state and local tax deduction limits were increased (maybe giving State Legislatures and County/City Councils something to think about, but not necessarily really).

The Balance Sheet Loses, Yet Again

There is no objective way to describe The OTB as anything but a deficit buster. The inclusion of a $5 Trillion increase to the debt ceiling (hopefully for Congressional Leadership) delays further serious discussion until 2027 (hint, hint).

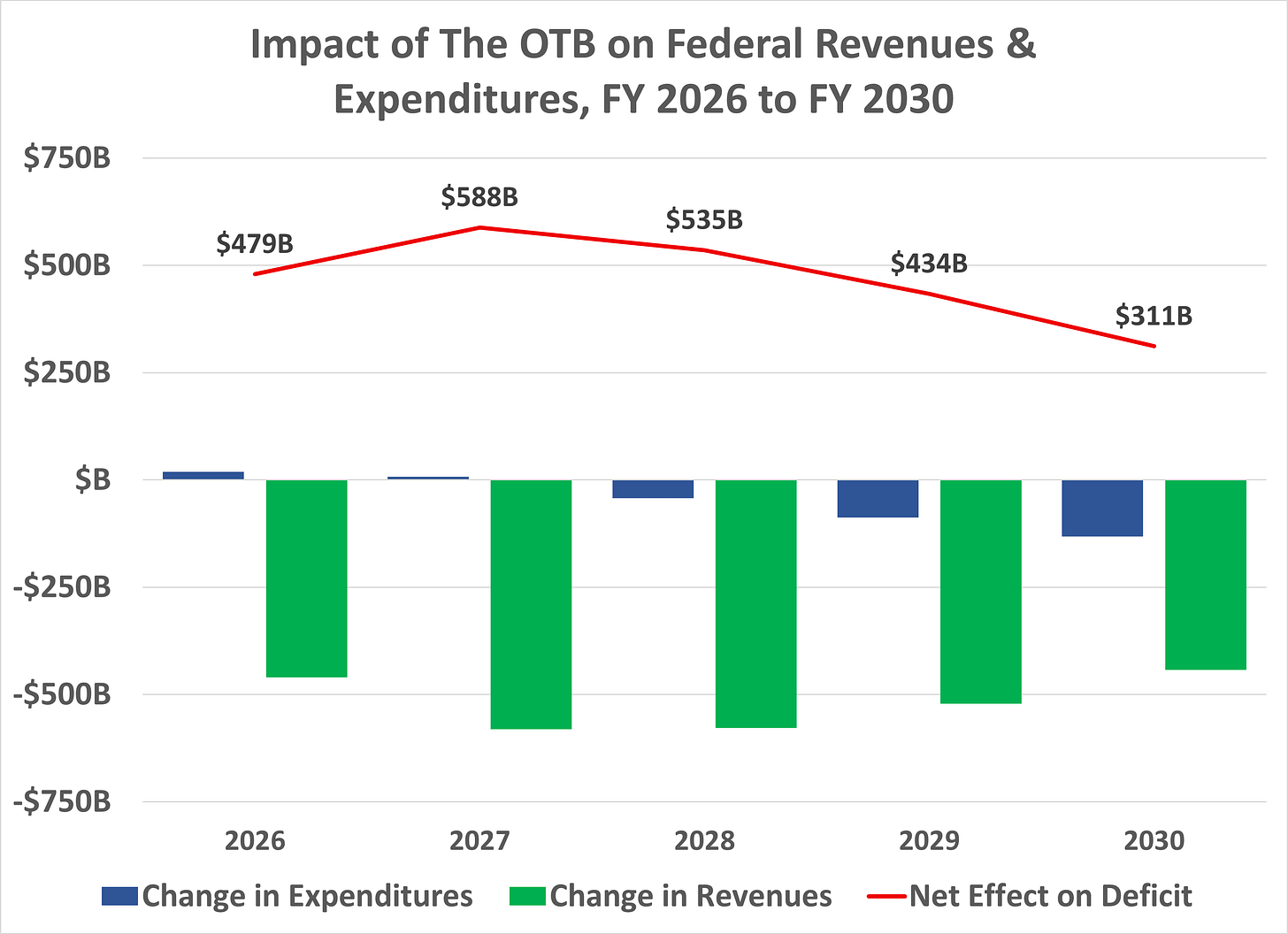

Those cuts in Federal spending for Medicaid are not enough to cover the impact of the expanded tax cut package, nor the selected spending increases (primarily on immigration policy enforcement and enhanced national defense). Based on the most-recently available estimate from the Congressional Budget Office, The OTB will increase their projections of the National Debt by about $2 Trillion in the next 5 years ($3.25 Trillion over 10 years, but I don’t believe 10-year estimates provided by anybody).

So, if you’re wondering why the President is going full force on Fed Chairman Powell, he would love to see interest rates trend downward so the carry costs of the extra Federal Debt help out the annual spending projections (especially when you see how the deficit balloons in FY 2026 and FY 2027).

Dealing with the Polarization

The President believes that every “deal” should have winners and losers, and The OTB certainly has them. Personally, this is where adaptation is key. Certainly, the political opponents of the President and the congressional majority will use this action as the focus of their efforts to at least turnover majorities in either or both the House or Senate next year. If the Administration and their supporters are interested in showing results between now and then, the role their majorities at the State level (at least when it comes to Medicaid and other prominent programs of interest to voters) will be critical to the potential for “Midterm” election success.

If you wanted to minimize the polarizing impact of this legislation becoming law, you could not pick worse timing. Again, objectively, you might as well as punch your political/ideological opponents in the forehead while wearing a ring imprinted with “Unity” to delivery a similar effect. My feed across friends and acquaintances certainly confirms this reality.

We will have to see what the impact is with respect to implementation. Both of the extremes of either side of the current political debate are not sympathetic (as we’ve seen in a select few of social media comments on the extreme challenges facing families waiting to hear the fate of their families and children missing as a result of extreme flooding in Texas along the Guadalupe River).

None of this helps anyone encouraging sincere reconciliation across our political and (rational) ideological differences (trust me, I’m only asking for civility, not unity). At this point, everyone’s focus has to include consideration to adapting to the impact of The OTB, so as if it is as bad as some people thing, we can work as citizens in private society (and the State level) to mitigate its worst.

Final Thought

Yes, my acronym about The OTB has its own meaning for us old folks (who grew up long before online wagering). Honestly, this legislation is a gamble for its supporters, and if I were them, I’d put my money where the mouth is, and make sure States and private society can cover the gaps created when it comes to access to necessities for our fellow Americans.

Share this post